Iron Ore Futures Surge 2.39% on High Domestic Prices

Increased Demand for DCE Iron Ore Futures

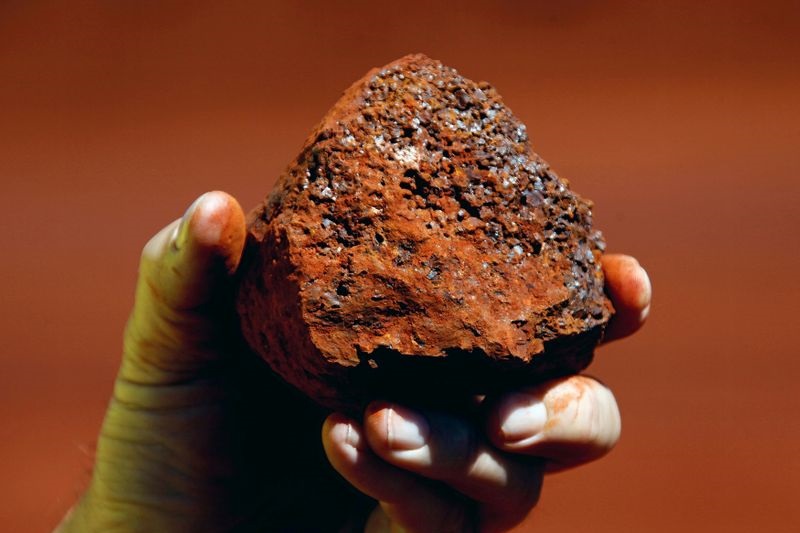

Today, DCE iron ore futures experienced a significant surge, climbing by 2.39% to reach 963.5 yuan per metric ton. This notable increase can be attributed to the current high domestic prices, which have impacted the purchasing behavior of steel mills due to weakened speculative demand.

Recorded PBF Transactions at Chinese Ports

During today’s trading, PBF (Premium Blast Furnace) transactions were documented at two major Chinese ports. Prices soared to 1010 yuan per metric ton at Shandong port and 1018 yuan per metric ton at Tangshan port. Despite the rise in futures prices, the elevated cost of iron ore has influenced the purchasing patterns within the industry.

Significant Increase in Inventory Levels

Additionally, there has been a substantial increase in inventory levels at these major ports. Over the past week, stockpiles have surged by more than three million tons, reaching a total of 115.1 million tons. This accumulation of inventory could signify a slowdown in consumption by steel mills, likely in response to the pressure of higher raw material costs.

AI-Generated Content Disclaimer

This article was created with AI support and reviewed by an editor. For more information, refer to our Terms & Conditions.