Gold Prices Stabilize After Record Highs Amid Strong U.S. Inflation Data

Gold Prices Steady in Asian Trade

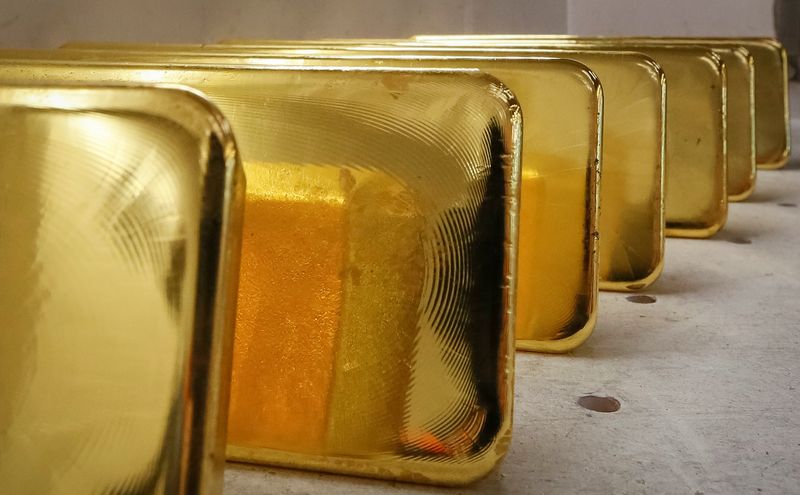

Gold prices steadied in Asian trade on Wednesday following a sharp decline from record highs after a robust U.S. inflation reading raised concerns about prolonged higher interest rates.

Impact of U.S. Inflation on Gold

The yellow metal experienced profit-taking after reaching $2,200 earlier in the week, triggered by expectations of early interest rate cuts by the Federal Reserve. However, the latest data cooled those expectations, leading to a decline in gold prices.

Current Gold Prices

Gold steadied at $2,159.32 an ounce, while futures for April dropped to $2,164.45 an ounce. Both prices were down approximately 2% from their recent record highs.

Record Highs for Gold

Spot gold reached a peak of $2,195.20 an ounce, with gold futures hitting $2,203.0 an ounce on Monday.

Focus on CPI Data and Rate Cuts

The latest CPI data indicated higher-than-expected U.S. inflation in February, maintaining levels above the Fed’s 2% annual target. This data diminishes the likelihood of early interest rate cuts, with traders still anticipating a 70% chance of a 25 basis point cut in June.

Economic Indicators to Watch

Upcoming economic indicators will play a crucial role in determining the future stance of interest rates. Any signs of economic resilience could delay rate cuts, impacting the demand for safe-haven assets like gold.

Pressure on Precious Metals

Gold and other precious metals faced pressure from the strength of the dollar and U.S. Treasury yields. Gold prices remained strong in 2024 despite these challenges.

Copper Prices and China’s Economic Outlook

Copper prices remained muted, with industrial metals impacted by China’s economic forecasts. Despite hopes for stimulus measures, China’s GDP target for 2024 remains conservative, affecting the demand for metals like copper.