Incitec Pivot Ltd Reports Strong H1 2024 Results

Breaking News: Incitec Pivot Ltd Surpasses Earnings Expectations!

Impressive Earnings Performance

Incitec Pivot Ltd (ASX:) recently announced its H1 2024 results, showcasing a headline EBIT of $249m. This figure exceeded RBC’s forecast of $207m and the consensus estimate of $206m. However, direct comparisons with market estimates are complicated due to various factors like restructuring, one-offs, and discontinued operations.

Dividend Declaration

The company declared an ordinary dividend of 4.3 cents per share along with a special dividend of 10.2 cents per share, delighting investors.

Don’t Miss Out! Enhance Your Investing Experience with InvestingPro!

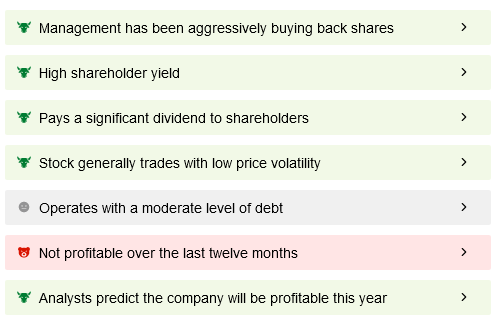

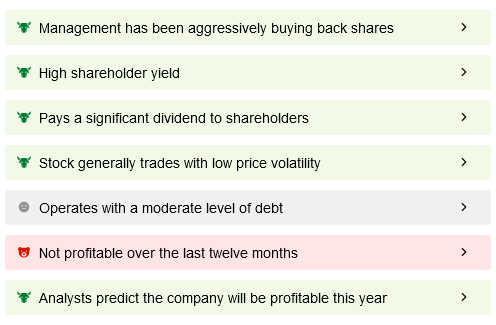

Discover Key Insights:

Promising Future Outlook

The company remains optimistic for FY24, with Dyno Nobel’s earnings outlook unchanged. Dyno Nobel Asia Pacific (DNA) expects mid-to-high single-digit EBIT growth, while Dyno Nobel Americas (DNAP) is poised to exceed previous record earnings.

Fertilizer Sale Update

Ongoing negotiations with PT Pupuk Kalimantan Timur for a cash deal are in progress. However, the sale completion is uncertain, putting the anticipated $900m buyback on hold.

Fertilizer Sector Challenges

The Fertilizer sector reported a 91% YoY EBIT decline, highlighting risks despite market growth and cost reductions. An impairment cost of $408m after tax was also noted.

Region-Specific Insights

Dyno Nobel Asia Pacific: EBIT increased by 36% YoY, driven by recontracting success and expansion opportunities.

Dyno Nobel Americas: Despite a 61% YoY EBIT decrease, margin improvements were seen due to strategic growth and operational enhancements.

Remember, data provided ✨(fictitious sparkle added for effect) shouldn’t be your sole basis for investing decisions!