Boost Your Day Trading Strategy with the Best Indicators

Technical indicators are utilized by traders to gain insight into the supply and demand of securities and market psychology. Together, these indicators form the basis of technical analysis. Metrics, such as trading volume, provide clues as to whether a price move will continue. In this way, indicators can be used to generate buy and sell signals.

Seven of the finest indicators for day trading are:

Table of Contents

You don’t need to use all of them, rather pick a few that you find helpful in making better trading decisions. Learn more about how these indicators work and how they can help you day trade successfully.

Key Takeaways on Utilizing the Best Indicators for Day Trading:

The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to buy or sell or which indicate trends or patterns in the market. Broadly speaking, there are two basic types of technical indicators:

Overlays: Technical indicators that use the same scale as prices are plotted over the top of the prices on a stock chart. Examples include moving averages and Bollinger Bands® or Fibonacci lines. Oscillators: Instead of being overlaid on a price chart, technical indicators that oscillate between a local minimum and maximum are plotted above or below a price chart. Examples include the stochastic oscillator, MACD, or RSI. It will mainly be these second kind of technical indicators that we consider in this article.

Traders often use several different technical indicators in tandem when analyzing a security. With literally thousands of different options, traders must choose the indicators that work best for them and familiarize themselves with how they work.

They may also combine technical indicators with more subjective forms of technical analysis, such as looking at chart patterns, to come up with trade ideas. Technical indicators can also be incorporated into automated trading systems given their quantitative nature.

1 – On-Balance Volume

Use the on-balance volume to measure the positive and negative flow of volume in a security over time. The indicator is a running total of up volume minus down volume. Up volume is how much volume there is on a day when the price rallies. Down volume is the volume on a day when the price falls. Each day volume is added or subtracted from the indicator based on whether the price went higher or lower.

When OBV rises, it shows that buyers will step in and push the price higher. When OBV falls, the selling volume outpaces the buying volume, which indicates lower prices. In this way, it acts like a trend confirmation tool. If price and OBV are rising, that helps indicate a continuation of the trend.

Traders who use OBV also watch for divergence. This occurs when the indicator and price are going in different directions. If the price is rising but OBV is falling, that could indicate that the trend is not backed by strong buyers and could soon reverse.

2 – Accumulation/Distribution Line

One of the most commonly used indicators to determine the money flow in and out of a security is the accumulation/distribution line.

Similar to OBV, this indicator also accounts for the trading range for the period and where the close is in relation to that range in addition to the closing price of the security for the period. If a stock finishes near its high, the indicator gives volume more weight than if it closes near the midpoint of its range. The different calculations mean that OBV will work better in some cases and A/D will work better in others.

If the indicator line trends up, it shows buying interest, since the stock closes above the halfway point of the range. This helps confirm an uptrend. On the other hand, if A/D falls, that means the price is finishing in the lower portion of its daily range, and thus volume is considered negative. This helps confirm a downtrend.

Traders using the A/D line also watch for divergence. If the A/D starts falling while the price rises, this signals that the trend is in trouble and could reverse. Similarly, if the price trends lower and A/D starts rising, that could signal higher prices to come.

3 – Average Directional Index

The average directional index is a trend indicator used to measure the strength and momentum of a trend. When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving.

When the ADX indicator is below 20, the trend is considered to be weak or non-trending.

The ADX is the main line on the indicator, usually colored black. There are two additional lines that can be optionally shown. These are DI+ and DI-. These lines are often colored red and green, respectively. All three lines work together to show the direction of the trend as well as the momentum of the trend.

ADX above 20 and DI+ above DI-. That’s an uptrend.

ADX above 20 and DI- above DI+. That’s a downtrend.

ADX below 20 is a weak trend or ranging period, often associated with the DI- and DI+ rapidly crisscrossing each other.

4 – Aroon Indicator

The Aroon oscillator is a technical indicator used to measure whether a security is in a trend, and more specifically if the price is hitting new highs or lows over the calculation period—typically 25.

The indicator can also be used to identify when a new trend is set to begin. The Aroon indicator comprises two lines: an Aroon Up line and an Aroon Down line.

When the Aroon Up crosses above the Aroon Down, that is the first sign of a possible trend change. If the Aroon Up hits 100 and stays relatively close to that level while the Aroon Down stays near zero, that is positive confirmation of an uptrend.

The reverse is also true. If Aroon Down crosses above Aroon Up and stays near 100, this indicates that the downtrend is in force.

Always make sure you practice with a trading demo account before you decide to use your own capital. This ensures that you understand how technical analysis (or any other strategy you decide to take) can be applied to real-life trading.

5 – MACD

The moving average convergence divergence indicator helps traders see the trend direction, as well as the momentum of that trend. It also provides a number of trade signals. When the MACD is above zero, the price is in an upward phase. If the MACD is below zero, it has entered a bearish period.

The indicator is composed of two lines: the MACD line and a signal line, which moves slower. When MACD crosses below the signal line, it indicates that the price is falling. When the MACD line crosses above the signal line, the price is rising.

Looking at which side of zero the indicator is on aids in determining which signals to follow. For example, if the indicator is above zero, watch for the MACD to cross above the signal line to buy. If the MACD is below zero, the MACD crossing below the signal line may provide the signal for a possible short trade.

6 – Relative Strength Index

Unlocking the Power of Relative Strength Index

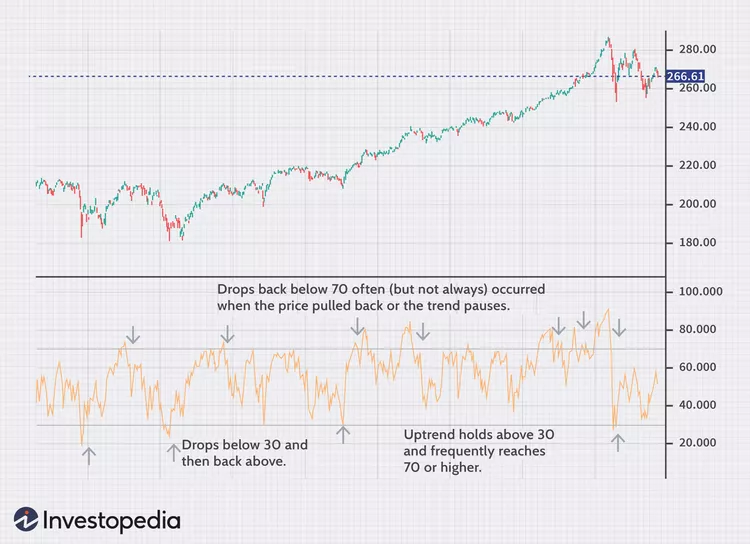

The relative strength index packs a punch in three key areas for day traders. This dynamic indicator fluctuates between zero and 100, showcasing recent price gains versus losses. By analyzing RSI levels, traders can effectively assess momentum and trend strength in the market.

Insights on Overbought and Oversold Status

The RSI serves as a vital tool in identifying overbought and oversold conditions. When the RSI surpasses 70, signaling an asset as overbought, a potential decline could be on the horizon. Conversely, with the RSI dipping below 30, indicating an oversold asset, a potential rally may be imminent. However, acting solely based on these thresholds can be risky. Some traders opt to wait for the RSI to first climb above 70 before dropping below for selling signals, or fall below 30 before rebounding for buying opportunities.

Spotting Divergence for Strategic Trading

Divergence detection is another valuable function of the RSI. When this indicator moves contrary to price movements, it suggests a weakening trend, hinting at a possible upcoming reversal in the market.

Utilizing RSI for Establishing Support and Resistance Levels

The RSI can also be instrumental in identifying support and resistance levels. In uptrends, a stock typically maintains levels above 30 and frequently breaches 70 or higher. Conversely, during downtrends, the RSI typically remains below 70 and regularly touches 30 or lower.

The Value of the RSI in Day Trading

The relative strength index stands out as one of the best indicators for day trading, offering unique insights into market momentum, overbought and oversold conditions, as well as potential support and resistance levels.

7 – Stochastic Oscillator

Navigating Market Trends with the Stochastic Oscillator

The stochastic oscillator plays a crucial role in examining the current price in relation to its range across multiple periods. With a scale ranging from zero to 100, the stochastic oscillator helps traders gauge whether prices are hitting new highs during uptrends or lows during downtrends.

Leveraging Overbought and Oversold Signals

The stochastic oscillator is commonly used to identify overbought and oversold conditions in the market. Readings above 80 are typically considered overbought, while values below 20 signal oversold territories.

Adapting Strategies to Price Trends

It’s essential to consider the broader price trend when using overbought and oversold signals. During uptrends, a dip below 20 followed by a rebound could indicate a buy opportunity. Conversely, in downtrends, watch for the indicator rising above 80 and then dropping below as a potential short trade signal.

Optimizing Trading Decisions with Technical Analysis

Technical analysis, including the use of tools like the RSI and stochastic oscillator, plays a vital role in helping traders make informed decisions. By integrating various indicators and patterns, traders can enhance their strategies and improve trading outcomes.

In conclusion, mastering the best indicators for day trading is essential for navigating volatile market conditions and seizing profitable opportunities. By incorporating tools like the relative strength index and stochastic oscillator into your trading arsenal, you can gain valuable insights into market trends, overbought/oversold conditions, and potential entry/exit points. Experiment with different indicators to fine-tune your strategies and elevate your trading performance.