Gold Hits Record High as Optimism Grows

Record Highs and Growing Optimism

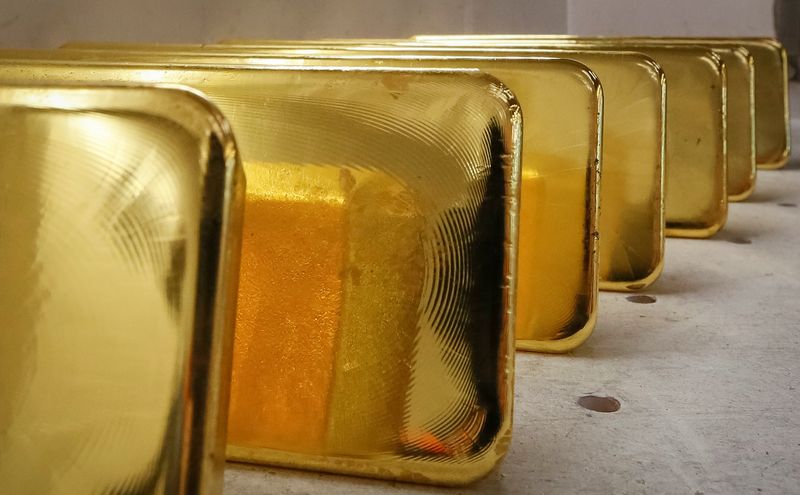

Gold prices soared to new heights, surpassing $2,200 for the first time ever. This surge was fueled by increasing optimism regarding major central banks potentially cutting interest rates in the near future, alongside ongoing geopolitical tensions.

Setting New Records

Gold for April delivery on the Comex division of the New York Mercantile Exchange reached a record high of $2178.6 per troy ounce after peaking at $2,202.35. This marked a 4% gain for the week, reflecting investors’ reactions to signals of imminent rate cuts.

Market Reactions and Economic Indicators

Investors responded to central bank statements and economic data, such as the robust jobs report showing 275,000 new jobs created in the US. Despite positive figures, concerns about rising unemployment hinted at a potential market cooldown.

Impact of Rate Policies

The 2-year Treasury yield dropped, aligning with market expectations of rate cuts. Speculation was further fueled by the European Central Bank’s inflation forecast adjustments, suggesting a rate cut as early as June. Lower interest rates make gold more attractive compared to interest-bearing assets like bonds.

Global Trends and Central Bank Actions

While some investors left gold exchange traded funds, global central banks continued to buy gold, aiming to diversify their reserves. In 2022, central banks purchased 1,037 tonnes of gold, nearing the all-time high. This trend is expected to continue, especially as consumer inflation data impacts US interest rate decisions.